SBA Business Lenders

The U.S. Federal Government is the nation’s largest supplier of financial or financial help for small businesses. Capital funding programs (including the Small Business Investment Company program, the New Markets Venture Capital program, the Small Business Innovation Analysis SBIR program, the Small Business Know-how Transfer program STTR, and growth accelerators).

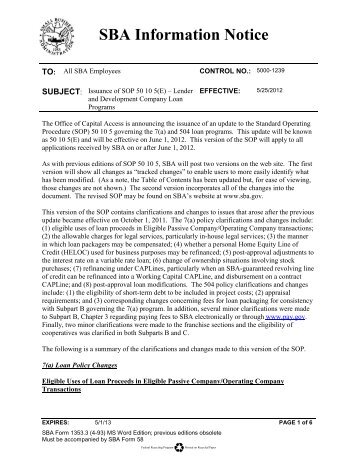

The report additionally discusses current programmatic adjustments ensuing from the enactment of laws (resembling P.L. 111-5 , the American Recovery and Reinvestment Act of 2009, P.L. 111-240 , the Small Business Jobs Act of 2010, P.L. 114-38 , the Veterans Entrepreneurship Act of 2015, P.L. 114-88 , the Restoration Enhancements for Small Entities After Disaster Act of 2015 RISE After Disaster Act of 2015, P.L. a hundred and fifteen-123 , the Bipartisan Budget Act of 2018, and P.L. a hundred and fifteen-189 , the Small Business 7(a) Lending Oversight Reform Act of 2018).

4 further programs are offered recommended funding in appropriations acts beneath ED packages, but are mentioned in other sections of this report because of the nature of their help: (1) the SBA’s Growth Accelerators Initiative ($2 million in FY2019) is a capital investment program and is discussed in the capital entry packages part; (2) the SBA’s 7(j) …

Read More »